Content

In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Kane is also behind peer-reviewed publications – which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers. Many newbie traders make the mistake of signing up with the first broker that they come across. The smart thing to do is to actually compare your chosen broker with that of an industry-leader like eToro. After all, FCA broker eToro is now home to over 13 million investors, so it must be doing something right. If these limits don’t quite suffice your personal risk tolerance, you only have two options.

How do I withdraw money from CMC?

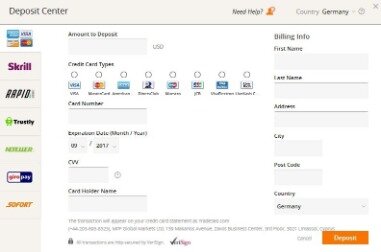

How can I withdraw funds from my account? You can withdraw funds from your account online by clicking on the ‘Payments’ icon and then selecting the ‘Withdrawals’ tab. Alternatively, you can use chat (Live help) or call our Client Management team for assistance.

ETX Capital does not charge any trading commissions as everything is built into the spread. The specific size of the spread will vary depending the asset and current market conditions.

The name ETX Capital reflects the company’s core businesses of electronic trading, telephone trading and execution services. As the name suggests, this lists enables a trader to keep an eye on specific markets. With the drop and drag function on the platform, traders can add particular markets to the list. Limited account options – There have been some complaints about the limited account options. Just one standard account means there are no financial incentives and benefits for traders with significant capital. Because they are regulated, compliance with a number of measures to protect consumers have to be met. This should put intraday traders at ease that ETX Capital is a legitimate broker, concerned about customers as well as their dividends.

Etx Capital Spread Betting Account

To start the process of opening an account with ETX Capital you can visit their website here. ETX Capital support a wide range of languages including English, French, Spanish, German, Polish, Czech, Greek and Mandarin. Visit ETX Capital Visit IG Visit XTB All fees/prices are for informational purposes and are subject to change. If you were to buy one standard lot of EUR/USD with ETX Capital at an exchange rate of 1.1719 and then sell it the next day at the same price you would likely pay $20.1. Here’s a rough breakdown of the fees and how this compares against IG & XTB . User reviews show they can help you with everything from binary login details and forgotten passwords to pip calculators and guidance when the website is down.

Before a client can make their first deposit or withdrawal, they must submit all of the necessary verification documents. See the available deposit and withdrawal methods overviewed below. On the ETX Capital platform, at least one webinar is arranged per week. The webinars discuss a variety of trading topics, including technical metrics, trading strategy, and the impact of various occasions on the markets. Five eBooks can help those who are new to the world of forex trading. Technical metrics, various stocks, investment techniques, business forecasting, and other subjects are included in the books. Options – options offer a useful addition to normal spread betting and CFDs.

Daytrading.com may receive compensation from the brands or services mentioned on this website. For additional guidance and other options, see our brokers list.

Leave this blank if you’d like to publish your review anonymously. Compare these ETX Capital alternatives or find your next broker using our free interactive tool. CFDs are leveraged products and can result in the loss of your capital.

There is a £100minimum deposit requirement at ETX, though you must have sufficient funds in your account to open trades. The download is quick and simple, and traders can login and trade quickly. In the Open positions window, traders are offered a ‘Sell’ value for their trades.

Instead, you are merely speculating on the company’s future price. Check out the leverage limits listed below for UK-based retail traders. However, some CFD products come with less competitive spreads. For example, the Europe 50 market comes with a spread of 2.0 pips. Although ETX Capital doesn’t have the most extensive forex department in the online space, it does offer more than 2,500 CFD instruments.

Offering higher leverage, more control over closed trades and more trading options. Education – There is an array of free educational material available to traders, including seminars, tutorial videos, user guides and manuals. These resources can prove particularly useful for novice traders. Automated trading – The MT4 platform allows for APIs and extensions so you can enlist the services of trading robots and EAs. Education – The broker offers a vast range of free educational resources. This includes training modules, downloadable files, video commentary and more. All of which can help you with everything from basic definitions to implementing complex strategies.

Etx Capital’s Trading Instruments

Two charting applications are offered, a Light Plus chart and an Advanced chart. All platforms now require the installation of flash player in order to perform optimally. I invested on a website, at first everything felt normal till I tried withdrawing my profits after a month and I didn’t receive any money. It’s a question you wish you didn’t have to ask, but it’s a necessary one if you’ve been scammed. I’ve seen my fair share of internet scams over the years, so I know how it feels. The good news is, I also know some practical ways you can go about getting your money back from the scammers. Hello everybody, I’m bringing to your notice that you can recover your funds from any which way you’re been scammed, binary option, credit card fraud, bank transfer funds, etc.

All important categories such as Forex, CFD trading and Markets can all be found on the homepage on the main menu. They also have appropriate sub categories so you can easily find your way around.

Etx Capital Trading Platforms

There are no deposit fees to consider, although you’ll need to fund your account with at least £100. Below we have listed the payment methods that ETX Capital supports. As a responsible broker with a track record that exceeds five decades, ETX Capital will ask you questions to determine whether or not you are suitable for online trading. More specifically, CFD instruments and forex are highly risky asset classes, especially if applying leverage. As such, you’ll need to state your prior trading experience, and the types of assets you’ve previously invested in. On top of boasting a long-standing track-record that exceeds 50 years, ETX Capital is also regulated by a number of leading licensing bodies. This includes the UK’s FCA, meaning you’ll be covered by its £85,000 investor protection scheme.

ETX TraderPro also comes jam-packed with a variety of risk management tools. This includes a plethora of order types – such as stops and limits, subsequently allowing you to calculate your the potential risks and rewards of each trade. ETX TraderPro can also be downloaded as a mobile app and is compatible with both iOS and Android devices.

In addition to MetaTrader 4, the broker provides a trading platform enhanced with multiple watchlists, guaranteed stops and trading accessible directly via charts. Spreads (EUR/USD starting at 0.7 pips) and commissions (0.08% for shares) are among the lowest in the market. ETX Capital is a zero commission trading brokerage which means they incorporates their trading fees into the spread rather than charging a commission for each trade.

- This feature is not available at ETX Capital, which is a major shortfalling.

- Finally, we’ve listed some of the popular funding methods that ETX Capital offers its traders below.

- This is evident in the sheer number and depth of features, tools, and order types available on its ETX TraderPro platform.

- In 2018, the broker was also named the winner of the ‘Best Spread Betting Site’ award at the global financial awards.

That includes users from Australia, Ireland, Germany, Spain, India, and Indonesia. Note ETX Capital does not offer a swap-free account for Islamic traders. The Pro platform includes the professional client service which had made ETX a popular choice among full time traders.

Tradetime Review

This can be used to cash in profitable positions, or to reduce loses on trades which have moved against the trade. Traders can login at any time to view their current positions and sell them if they want to. The Call and Put buttons are clear, with the strike price illustrated between the buttons. Once highlighted, trader simply click on ‘Invest’ to confirm the trade. Once open, a trade will appear in the ‘Open Positions’ screen below the trading platform.

Practice accounts are a fantastic opportunity to build confidence and develop strategies. Then when you have gained experience, you can close your forex demo account from within your account area and upgrade to real-time trading. Although there is just a single live trading account, there is also a free demo account.

ETX Capital also offers a download software platform and is available on the go. Traders can take positions wherever they are on the move thanks to the full range of ETX mobile trading apps. All four trading platforms are available on Android powered smart phones and tables as well as on iPhones and iPads. ETX Capital doesn’t offer other types of bonuses, but if you contact the customer support service and ask for a bonus, you might get one.