It aims to keep such problems from popping up in the first place. Mobile Trading Apps– Being able to trade on the go may be important. Ideally the mobile platform will function just as the web based version. The Battle of Hastings A detailed account of the Battle of Hastings, including the origins of the conflict, the battle plan, details of the battle and a review of why Harold lost.

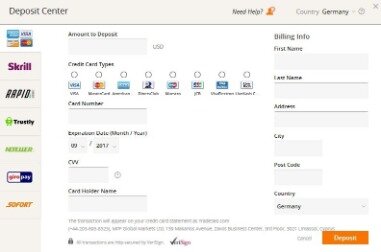

Transfer times are typically from one to five business days and one withdrawal per month will not be assessed a fee. Additional withdrawals will have fees that vary according to the currency withdrawn. Company Background and History– Knowing the past exploits of your forex broker can give you a better idea of what it is up to now. A listed company has to publish numerous elements of information about their balance sheet for example. You want peace of mind that your trading funds are segregated, and held safely and securely.

With that being said, it still does not mean that OANDA is the best option, as there are also hundreds of other regulated brokers with similar or even better trading conditions. At Oanda there are more than 70 forex pairs in total to choose from. This includes major, minor, and exotic pairs as well as trading in some forex futures. The spread here typically starts from 0.6 pips though can be as low as 0 pips if you are trading from Australia.

Costs And Accounts

This is the case on both the Standard and Core account types. The only exception here is if you are an experienced high volume trader, or corporation and opt for an Oanda premium account then the minimum deposit will be $20,000 or 25,000 CAD. Here is a closer look at some of the Oanda minimum deposits and the deposit methods that you will find available when trading with the broker. Protecting your funds as a trader is of the utmost importance.

- Sadly they are cheaters, so I have had enough at this point.

- The bid/ask spreads are almost identical to those offered by FOREX.com and FxPro.

- For a trader who feels comfortable with the charting platform such as NinjaTrader or MultiCharts, OANDA is the best option.

- Education– It never hurts to improve your understanding of how the forex markets work and how you can make the most of the opportunities they present.

- Customer service at Oanda is delivered through a number of mediums in a professional, and speedy manner.

- The Oanda corporation is a Market Maker Forex brokerage that traces its origins to 1996, when it was incorporated in the state of Delaware.

Let’s now take a look at how Oanda measures up in this respect and exactly which trading platforms are made available. This is the fee charged for holding a position overnight which is charged once the market has closed. This fee applies to all assets you trade with Oanda since they are CFDs. Since it is a dynamic fee, you can find more information on the fee for that day through the broker’s platform.

The Forex Trading Platform

The mobile platform provides exceptional market research inclusive of unmatched charting features. However, it is void of some other essential components just as the web-based and desktop application of OANDA.

Is Oanda regulated by MAS?

OANDA. OANDA is a multi-regulated market maker broker that offers Singaporean traders’ commission-free trading on a range of contracts for difference (CFDs). The online broker is overseen by five major regulatory bodies, with OANDA’s Asia Pacific operations regulated by the Monetary Authority of Singapore (MAS).

Users have to pay fees for deposits, withdrawals, bank wire transfers, debit card and ACH transactions. The research consists of high-quality content which makes it very valuable. This content includes advanced technical analysis, macroeconomic news, research from USB, access to AutoChartist and much more. At a monthly fee, a trader can also get Dow Jones Select on the platform. Apart from the trading opportunities, the research tools, news, and market analysis available at OANDA are best-in-class. In addition to this, it offers unmatched options for algorithmic trading.

Oanda Cfd & Forex Trading Review

We verify and compare brokerage companies and warn our readers about suspicious projects or scam marketing campaigns. We are also a community of traders that support each other on our daily trading journey. The source of this information is the website and the broker’s trading platform listed in the Web section of this review. Please verify whether the broker is authorized to provide its services in your country of residence in accordance with the legal regulations that apply to its business. When it comes to education at Oanda you will be pleased to note that this is very well provided for by a comprehensive, and award-winning education section. When it comes to trading platforms and flexibility, brokers have to deliver in terms of both quality and mobility.

Is Oanda legal in India?

How To Start Forex Trading In India? As I have mentioned earlier that when forex trading was introduced in India, there were only foreign brokers like FXCM, ALPARI, GCI, AVA, OANDA, etc. Forex is legally allowed within Indian Exchanges, BSE, NSE, MCX-SX (Multi commodity exchange).

In this regard you want to be with a broker who makes provisions to ensure this protection. Firstly, Oanda Europe provides negative balance protection to traders there. This means that you will never lose more than you have deposited if you are a European registered trader. Starting our Oanda review we will take an in-depth look at a vital area of the broker for all traders. This area is security, something that we all need to consider when choosing a new broker.

This uniquely positions Oanda as a broker that has their finger on the pulse of markets and traders needs around the world. No matter where you are from, it is likely you will find something to fit your needs here. Spreads too remain low, particularly for Australian-based traders who can take advantage of the core account where spreads can start from 0 pips with a 3.50 AUD commission. The premium account which has commission included starts with a 0.6 pips spread. The mobile application of OANDA is one of the prominent reasons for its popularity. As more and more traders transition to mobile platforms, the simple, easy to use the mobile application of OANDA makes it one of the top platforms preferred by new traders.

A trailing average spread across nearly all the timeframes is frequently published which provides greater transparency in terms of pricing. But, an accurate comparison is not easily derived as OANDA does not publish a specific number for the average spread over a fixed period. Oanda offers over 100 different instruments to trade, including over 71 currency pairs. We’ve summarised all of the different types of instruments offered by Oanda below, along with the instruments offered by IG and XTB for comparison.

Customer Support– You need someone to talk to when you run into problems with your deposits, actual trading, or – God forbid – withdrawals. From opening an account, to help with the platform, customer support can be important. OANDA is a broker licensed and regulated by the ASIC, FCA and CFTC. While regulation gives to brokers much needed credibility, it still does not mean every regulated broker is honest. In order to be sure that OANDA is not a scam, read our trader reviews and check other popular trading related websites and forums.

CFDs are leveraged products and can result in the loss of your capital. To start the process of opening an account with Oanda you can visit their website here. Finally, we’ve listed some of the popular funding methods that Oanda offers its traders below. With Oanda, the minimum and maximum trade requirements vary depending on the trader and the instrument. All contents on this site is for informational purposes only and does not constitute financial advice.

It is regulated in six tier-1 jurisdictions, making it one of the safest brokers for Forex and CFDs. Trading CFDs, FX, and cryptocurrencies involves a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Foreign exchange management software in the Indian Market. Helps you to handle accounting and complete Forex Operations. In addition to this, the support website also provides sufficient services with its vast knowledge base and searchable archive that usually answers most queries. Under this one account, a user can open up to 19 sub-accounts which allows further flexibility when you want to have different base currencies under one account.

You can also play the Flash game to decide the future of England as either Harold or William. Lovereading4kids Lovereading4kids is a book website for parents and children to help make book choices easier. ChildTasticBooks A superb blog with great reviews of children’s books. Well worth delving into if you are looking for ideas for books for your child or class. In order to start trading with OANDA, you have to deposit at least 0 USD.

You have all the tools needed to trade just a few clicks away, not to mention a whole host of useful additional features. On the downside, the platform lacks an ultra-modern look and some functions are awkward to use. Instead of being able to open the news, forums and economic analysis in the platform, they open as web pages in separate browsers. Again, you open Oanda’s order book outside the application. This can all prevent a smooth trading experience at times.

Write A Review

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website. The commisions and spreads displayed below are based on the minimum spreads listed on Oanda’s website. The colour bars show how competitive Oanda’s spreads are in comparison to other popular brokers featured on BrokerNotes. It is also worth highlighting, some negative Oanda customer reviews pointed out customer service response times can be slow. However, hotline staff remain polite and helpful, endeavouring to use their support website and archives to answer your questions fully. ECN –Oanda is not an ECN broker, it is a market maker and some people believe you find lower spreads with ECN brokers.

On the negatives, creating or amending EAs can be challenging. This is especially true for new traders who may be unfamiliar with the unique programming language. Whilst the audible alerts can be annoying, there are customisability options, not to mention a mute button, so we can let that drawback slide. It is time to move onto the FxTrade part of the review, an essential component of the Oanda offering. Overall, the system is well designed and easy-to-use, offering a multitude of tools and analytics. Oanda’s trading fees are straightforward and highly competitive.

This system is easy to use and includes a multitude of tools, but the interface looks and feels a bit outdated. Charters will be happy to learn that you can trade directly from the chart in FxTrade. Trading in Forex and Contracts for Difference is highly speculative and involves a significant risk of loss. The information contained in this publication is not intended as an offer or solicitation for the purchase or sale of any financial instrument.

For a major and experienced broker, it is true that the number of assets available for trading at Oanda can be quite limited. The total offered is little more than 100 assets, and every asset you see here may not be offered in some trading areas. Nonetheless, here are the markets and assets that Oanda makes available. The Oanda mobile trading platform harnesses much of the functionality of the desktop variety and provides for another very intuitive and easy to use experience for you as a trader. Incorporated here you will find a range of mobile charting capability that is tough to beat alongside dozens of technical indicators and tools at your disposal.

These start with the quite limited selection of available assets for such a major broker while this can also be said of the few base currencies they make available. Another big detraction for some traders, in particular, is the lack of any direct copy and social trading features. You can copy trading strategies through the EAs feature of MetaTrader but it does not provide quite the convenience. This means that regardless if you are brand new to trading or have more experience, you should find something suitable with Oanda. The only downside here is that there are quite few deposit or withdrawal methods open to you from the broker.