You Are NOT Allowed to change the leverage when trading with this broker. Having said that, since trading CFDs brings the risk of losing your capital, you might want to be able to change the leverage. The negative side here is thatYou CAN NOT change the leverage when trading with the city index. Due to the U.S. and Canada regulation, citizens of these 2 countries cannot open the CFD account with Plus500. Citizens of other countries are fine to go through the account opening. By the way, there is only one choice of accounts with Plus500.

The typical SaxoTraderGO quote includes a chart, news, general company information, analyst recommendations , and fundamental data. The SaxoTraderGO platform is loaded with trading tools and excellent usability, regardless of whether you are a new or seasoned trader. Like the SaxoTraderGO web platform, the SaxoTraderGO mobile app is brilliant. Placing trades is quick and easy, while watchlists and price alerts sync with the main trading platform. We all have experienced or have seen the impact of Covid-19 on the financial market. Interestingly, many people decided to give trading a shot and make money by trading CFDs. One of the most important factors that concern both beginners and professional traders is brokerage fees.

Best Trading App In 2021

IG’s other tool to market researchers is ‘Heatmap,’ which visually draws the hotspots and shows the winners and loser traders. AS you know, it tracks the long and short positions of traders and clients, so you can know what happens in the market. The amount ofinvestor protection is £85,000 for UK residents, Swiss 100,000 CHF, and €20,000 for Europe. Since Canada and USA regulation is different from the rest of the world, we have listed the best forex brokers in Canada here. PLEASE NOTE THAT TRADING CFDS IS NOT YET ALLOWED IN THE USA. IG is also a good broker for risk management, especially when their platform gives you features to set up price change alerts. Before we share the top CFD brokers of the year, let’s have a look at the characteristics of the best CFD brokers in today’s market.

There is no minimum deposit, but the trader needs to have funds available to buy and share. Overall, the only negatives of XTB are that its fundamental data is limited, and there are high fees for some CFD trades. XTB uses its xStation 5 platform, which offers good customisation, search functions and modern design. It is regulated by the FCA and listed on the Warsaw Stock Exchange. To open an Active Trader account, you need a deposit of $25,000. There are excellent educational tools, including a demo account, and customer service is available via live chat and phone Monday to Friday.

Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 65-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money. fxexplained.co.uk is an affiliated partner with various forex brokers and may be compensated for referred forex traders. We have prepared plenty of step-by-step guides for Beginners and newbies that help you get started with online trading and open your demo account on the best CFD brokers for beginners. Since trading CFD risk is high, we encourage you to be extra careful and don’t attempt to trade big if you are not that ready.

Can I buy CFD without leverage?

CFD assets traded without leverage have the same risk as those assets traded directly. On eToro, for example, you can invest in any asset without applying any leverage. However, trading CFDs with leverage increases your market exposure, thereby, increasing your risk.

Investors will generally pay closer to the high price to buy and sell nearer the low price. There are likely to be additional ‘paid for’ features added as time goes by which will be another source of revenue for the platform.

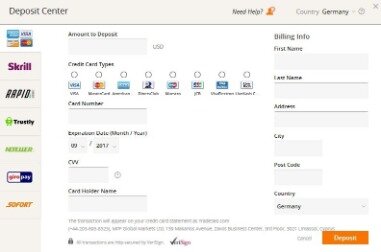

Withdrawals And Deposits

But other than that and the higher spreads they were good. I then got told the position was being delisted within a month.

On the other hand, Plus500 embraced Web trader and encouraged online traders to use browsers or install Plus500 trading mobile app that works just fine on iPad, iPhone, and Android. Although it’s not based on desktop, web trader and mobile apps’ search functionality is very smooth and strong. You won’t be able to change the leverage level; This is a negative point.

Is trading 212 CFD only?

CFDs are contracts with Trading 212 UK Ltd. as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Thus, exchange and clearinghouse rules and protections do not apply to trading CFDs with Trading 212 UK Ltd.

Through MT5, traders will find it easier to build their own custom indicators and expert advisors. While most of their industry peers seem set on offering a bewildering array of trading platform options, CAPEX have apparently decided to keep things as simple as possible in this regard.

There is a minimum deposit of $300 and it can take up to three days to open an account. Specialising in cryptocurrencies, FXCM offers low trading fees but high withdrawal fees. The trading platform is native to eToro and has been designed with new traders in mind. A good place for newcomers to the CFDs market, at MF Global market prices are true, and charting and UK level 2 prices are also provided. Traders can submit their own bids and offers into the real market. Most major stock markets and exchange traded ETFs are available. There are 8 base currencies available, with further currencies available on request.

XM is not only a regulated broker but also is among the best CFD brokers in South Africa. It offers a fast & Free withdrawal process and low CFD fees, making it a competitor to the other online brokers.

Well, this is a broad question and really depends on what you trade and how to trade. When it comes to fees, our readers often ask, “Is city index good for spread betting & CFD Trading? ✓ $12 per month after 12 months of inactivity is what City Index charges which is one of the non-trading fees. Just remember that plus500 might charge you $10 inactivity fees per 90 days of inactivity. The CFD account opening process is instant, automated and very smooth.

Avatrade Review

The fourth account is available for buying shares on MetaTrader 5. As XM has a strong global presence with clients from 196 different countries, six regulated investment firms are trading under the XM brand, but technically, they are all XM. On the XM website, you can discover endless amounts of learning materials to help master the financial markets. With XM, you can trade on either MetaTrader 4 or MetaTrader 5 platforms on a variety of screens and devices. I had a good experience with IG while I traded with them. Also on their web based platform and their mobile app it only shows your profit/loss during a trade in the base currency for the pair. For example, if I was trading USDJPY my profit/loss on the chart will be in Yen.

Through it, they can also thoroughly assess the capabilities of the platforms and services offered by the brokerage. XTB offers all 3 trading platform types, mobile Apps trading, desktop trading software and web trading app. However, for this review, we would like to share a simple comparison table to show you AvaTrade forex fees and compare CFD trading platforms with XM & Plus500. It’s known to all traders that AvaTrade is one of the best commission-free Brokerthat offers low fees CFD trading service. Overall, trading with AvaTrade is cheaper than many other brokers such as IG.

From the broker’s fees perspective, Xtb stock index CFD fees are low. On the negative side, XTB’s stock CFD fees are relatively higher than their FX fees. You can easily find a daily summary of the financial market.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading 212’s big unique selling point is its zero-commission trading. There are no charges for share dealing or to hold stocks in an ISA wrapper. Trading 212 makes money through the spreads between the buy and sell price on their assets. There is also a 0.5% currency conversion charge and you will have to pay stamp duty for share and ETF purchases. The platform’s chief executive Ivan Ashminov has previously indicated that additional ‘premium’ services will be added to the platform, which users will need to pay to access.

- With all of your funds kept in segregated accounts, too, security and privacy really do come to the forefront of every decision made here at Capex.

- The top CFD broker list presented above results from hundreds of fact-checking and practically evaluating the brokerage companies and their services.

- You can easily find a daily summary of the financial market.

- The best part of SaxoTraderGO is the speed and simplicity at which the platform operates.

- INFORMATION LIBRARYThe most important FAQ’s answered and easy explanations about the financial products listed on our site.

The company is an extraordinary illustration of what a retail forex broker should be. Initially, the company was known as XEMarkets but eventually rebranded to the much shorter and catchier XM.

Open Your Account

This license says that the brokerage is MiFID-compliant and as such, it can peddle its services legally all through the EEA. Based in Cyprus, at 18 Spyrou Kyprianou Avenue, Suite 101, Nicosia 1075, Cyprus, CAPEX is regulated by CySEC. Details regarding this investor compensation scheme are provided at the site, in downloadable .pfd format. The same goes for all the terms and conditions and various policies observed by the brokerage.

When creating your demo account, you can choose various settings such as the account type, base currency, demo credit and leverage settings. XM is a brand name that is shared by various related sister companies. It is not unusual for large international forex brokers to operate as several different companies which are regulated in other jurisdictions. Brokers structure their companies this way in order to serve clients from different parts of the world.

Apart from “AvaOptions”, which is their modern trading Apps, AvaTrade is one of the best MetaTrader 4 brokers. Since the default CFD platform you can use based on MT4 , you can easily set up your account and fully customise your trading environment and dashboard. AvaTrade is one of the best regulated Low Fees brokers for forex trading, CFD trading, and trading crypto against fiat currencies.

We believe plus500 is among top-tier CFD providers in Australia after careful evaluation, especially because of its regulation history, safety, and low CFD fees. Plus500SEY Ltd is authorised and regulated by the Seychelles Financial Services Authority (Licence No. SD039). Plus500UK Ltd authorized & regulated by the FCA (#509909). Even though Plus500 has a global presence and is very active in most countries, its portfolio and the offer are limited to CFDs. Since you know what is CFD and how does it work, Let’s make a comparison and have a look at CFD fees and compare it with eToro & XTB CFD commissions. In case you are interested in seeing the fees for S&P 500 CFD, Europe 50 CFD, EUR USD, we have listed them below. Enhance your trading skills in the comfort of your own home.

Zero commission investing – Most of the main brokers or DIY investing platform charge a fee for buying or selling shares. This can be as much as £12 per trade, which is pretty costly for those trading regularly. Traders who analyze global markets will love the high-level breakdown of each exchange provided in the equities section on Saxo’s research platform. Investors who focus on technical analysis with be pleased with the chart patterns provided by Autochartist that identify trading signals. The best part of SaxoTraderGO is the speed and simplicity at which the platform operates. Going from a stock overview to charting technical indicators, and then finally placing a trade is flawless.