Content

Its fairly basic but its one I’ve personally used for years and come to be pretty familiar with so its always good to know that the broker can offer the standard platforms that most people are used to. Their minimum deposits, spreads, commissions and leverage amounts will vary depending on the account you choose. Swissquote has a derivatives trading platform called Swiss DOTS which will allow you to trade more than 70,000 OTC derivatives.

While you might be able to explore Swissquote’s platform straight away, it’s important to note that you won’t be able to make any trades until you pass compliance, which can take up to several days, depending on your situation. You’ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process. Swissquote also offer mobile apps for Android and iOS, making it easier to keep an eye on and execute your trades while you are on the move. Like most brokers, Swissquote takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

Its purpose is to empower Forex, commodity, cryptocurrency, and indices traders and investors with the news and actionable analysis at the right time. Before you can trade, you will need to verify your identity in addition to taking an Appropriateness Test. Once the account is confirmed, go to the dashboard to access your account, view its details, and make deposits or withdrawals. Non-trading fees refer to the charges that are not directly connected to trading. If the client does not conduct any trading activity for over 90 days, BDSwiss deducts 10% per month from your account.

It has adopted – based on the principle of self-regulation – a comprehensive set of its own regulations, directives and notices governing, inter alia, certain requirements for admission to trading and listing and disclosure requirements. The second Swiss stock exchange is the BX Swiss Ltd, in Berne, which is comparatively small and mainly focuses on domestic issuers. Since 2018, BX Swiss Ltd has been a wholly owned subsidiary of the Börse Stuttgart GmbH.

CompanyMarkets.com provide an in-house trading platform that is powerful yet friendly for the user. They give you access to all the popular markets including stocks, currencies, commodities and indicies. Markets.com are regulated by multiple authorities in Europe and provide a secure and transparent service, helping to make them one of the fastest growing Forex and CFD provider. They also provide 24 hour customer support five days a week and have zero commissions and fees on top their platforms.

The launch marks the first ESG indices for general Swiss markets, SIX claimed, with two indices now available for equities based on the Swiss Performance Index and 20 for bonds based on the Swiss Bond Index . There are several options on the website where you can click ‘Sign UP’ and will be taken to a page where you need to enter your name, country of residence, date of birth and email. Next steps will include uploading a document to prove your identity and then your account should be active and verified within 24 hours. An indicator based strategy that relies on two or more technical indicators is the best strategy for trading the SMI. For example, a combination of the Stochastic Oscillator and either the Relative Strength Index or Moving Average Convergence Divergence can deliver reliable trading signals.

A maximum of $8 commission is charged per transaction with leverage of 200 to 1. Spreads as low as 0 pips on EUR/USD, with the same position limits and lot restrictions on tickets as the Classic and SWISS11 accounts. ESG has been a major focus for market participants across the industry in recent years as investors increasingly seek out tools to facilitate more sustainable investment strategies. German exchange group Deutsche Börse confirmed plans to acquire data and analytics provider ISS in November to meet growing demand and enhance its ESG data offering. The SIX Swiss stock exchange has confirmed the launch of new environmental, social and governance indices for equity and bonds markets in Switzerland as demand for sustainable investment continues to soar. @bdswiss.com24/5 Live ChatRequest Call BackI think its worth noting too that the customer support team are multilingual so they’re able to cater to most people from all across the world! It is a bit of a red flag that there isn’t a normal support number you can ring, but at least you are able to request a call back.

There are 4 different account types to choose from when setting up with BDSwiss, including Classic, VIP, Raw and InvestPLUS. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. The index value is calculated by dividing the market cap of each individual component by a divisor. The divisor is a number that is established arbitrarily to produce a value that can be compared over time. The SMI Index is a component of the SMI® Family of the SIX Swiss Exchange, which also includes the SMI®, SMIM® and the SMI Expanded®.

Bdswiss Account Opening Process

For instance, it has several hotlines that individuals speaking different languages can use to speak to the company’s representative. You can also contact the company via email, WhatsApp, Live Chat, or Telegram. The customer care team is available at any time within the working days. BDSwiss is a Switzerland-based CFD and FX broker that commenced its operations in 2012. It is licensed in the U.S. by the National Futures Association, FSC, and CYSEC in the EU.

Crispus graduated with a Bachelor’s of Science in 2013, an MBA in 2017, and is currently working on an MSc in Financial Engineering from WorldQuant University. When he is not trading and writing, you can find him relaxing with his son.

- BDSwiss don’t offer deals or promotions on their site, however, traders can benefit from trading alerts and their education and free seminars are really useful for clients looking to expand their financial expertise.

- Traders receive up to 100,000 USD of virtual money to practice their trading strategies.

- Across the board, Swissquote’s fees are a bit higher than most brokers in the space.

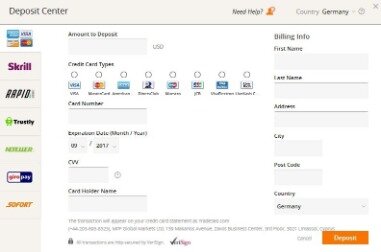

- When transferring the funds, you may also be charged by funding providers like the credit card provider, receiving bank, or intermediary bank.

It authorises their operations to engage in financial market activity and ensures that the supervised institutions comply with the requisite laws, regulations and ordinances and maintain their licensing requirements. FINMA has certain limited powers to enforce the provisions of the FMIA and to proceed with and take administrative measures against any failure to disclose shareholdings, insider trading and market manipulation. As a general rule, decisions of FINMA may be challenged at the Federal Administrative Court, the decisions of which may be appealed at the Federal Supreme Court.

About Bdswiss

We built BrokerNotes to provide traders with the information needed to make choosing a suitable broker easier and faster. Swissquote is an FCA-regulated FX & CFD broker offering 160+ trading products.

One of the reasons why BDSwiss is among the most popular FX and CFD broker worldwide is its feature-rich online framework. The company has trading conditions that are apt for traders of different levels of experience.

Zeusoption Forex Broker Review (

The value of the spreads varies throughout the day depending on volatility and conditions in the market. The VIP, Raw, and Classic accounts have spreads that start from 1.1 pips, 0.0 pips, and 1.5 pips respectively. With BDSwiss, one is not required to pay commissions or fees on most trades. We couldn’t discover an forex to make use of the MetaTrader4 platform, and the hyperlinks to the cell buying and selling apps didn’t work. Minimal deposit for a brand new buying and selling account is $250, and the minimal withdrawal quantity is $50. 2 Markets in Financial Instruments – Regulation No. 600/2014 of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Regulation No. 648/2012.

Finally, there is a robo-advisory account that has a high minimum deposit, starting at around £10,000. The fees will differ depending on if you are using the UK entity to trade or the Swiss-based entity. For the UK offering, you can gain discounts on trading fees if you deposit at least £10,000 and you are an active trader. There is a commission in place of £5 for a round trade, with the spreads generally being pretty low. The average spread cost for EUR/USD is 1.3 pips, which is about average for the sector. MT4 has all the fundamental features that individuals need to trade successfully. In contrast, MT5 is a more advanced platform that has additional features including hedging options.

A free demo account is available with all three platforms, offering access to over 130 financial instruments with no obligation or risk. Traders receive up to 100,000 USD of virtual money to practice their trading strategies. Swissquote’s in-house platform, Advanced Trader, comes with a fully customisable interface and allows trading in synthetic CFDs among other instruments. The platform’s smart features are designed for automatic pattern detection, making it the ideal tool for traders who are new to chart pattern analysis. The brokers also offers a robo advisory service that receives positive customer reviews.

Fees

Swissquote Group Holding Ltd is Switzerland’s leading provider of financial services and has been listed on the SIX Swiss Exchange since 2000. The group has offices scattered around Europe, Asia, and the UAE, and currently employs over 700 people. Small commissions (0.1%) are charged for stock CFD trades and also when you roll a trade over to the following day.

Classic STP – this account has a minimum deposit of $200 and has variable commissions depending on the base currency. This account allows for the most leverage of the four, with the maximum being 500 to 1. Maximum open positions or pending orders is for as many as 200 positions per currency pair, with a maximum of 50 lots per order ticket. The contract size consists of 100,000 units of the base currency for one whole lot. The sizes available to trade range from as small as 0.01 to a maximum amount of 50 whole lots per ticket. Leverage for three of the four account types is up to 200 to 1 in all currency pairs; however, the Classic account allows leverage of up to 500 to 1.

BDSwiss’ website has detailed information on the differences between the two trading platforms. You can download and use either of the two trading platforms on an Android or iOS device as well as your MAC or PC. The BDSwiss mobile app and the BDSwiss webtrader are also part of the firm’s trading platforms. Costs of trading and non-trading fees are higher than your typical broker. Lawsuits involving breaches of securities law are not common in Switzerland. To date in 2020, no relevant decisions have been published in the area of Swiss capital market law.

Weis Wave With Alert Indicator Review

However, if you want a broker with lower spreads on currency pairs like EUR/USD, Swissquote may be more appropriate. The next generation MetaTrader platform, MT5, offers a greater selection of tools and flexibility for the experienced trader. As with MT4, traders get unrestricted automated trading capabilities and access to plugins. In addition, MT5 users enjoy 80 built-in indicators, 44 analytical objects, and highly customisable charts with 21 timeframes. Clients can enjoy full mobility with access to the platform via desktop or web browser. Based in London, Swissquote Ltd is a subsidiary of Swissquote Bank and has been authorised and regulated by the Financial Conduct Authority in the United Kingdom since 2012. The broker provides over 160 forex and CFD instruments on award-winning platforms to over 360,000 clients worldwide.