London Capital Group – more commonly referred to as LCG, is an online broker that offers trading services to retail and institutional investors. Launched back in 1996, the platform is well-known in the UK brokerage arena. Although the platform has a great reputation in the public domain, it is important to note that LCG lost its publicly traded status in 2019. Now we have a lot of posts and interesting facts about trading. We do not use a lot of images and we are trying to help traders to learn some things from trading industry. When it comes to the education material the one that is being offered by the LCG includes some e-books, videos, charting in an advanced manner and even trading tools.

Crispus graduated with a Bachelor’s of Science in 2013, an MBA in 2017, and is currently working on an MSc in Financial Engineering from WorldQuant University. When he is not trading and writing, you can find him relaxing with his son. For the more experienced traders, you can open LCG’s classic account by clicking on ‘Open Live Account’. The first one includes your contact details, preferred currency and trading platform, and the password of your choice. Once you click on ‘Next’, you will be required to input certain personal details and your trading experience. London Capital Group Ltd are regulated by both the FCA in the UK and CySec in Cyprus. This level of regulation ensures the ESMA guidelines are adhered to – this limits leverage, ensures negative balance protection and strengthens ‘Know Your Customer’ protocols.

Head over to your account dashboard and click on the ‘UPLOAD DOCUMENTS’ button. 75% of retail investors lose money when trading CFDs with this provider.

Each review is based on our personal experience and fact-checking against the latest available online information. This includes depositing funds, using the trading platform, verifying our identity, and more. The directives are normally based on the trade size, instrument and others. They are usually billed in the currency denominations of the account used for trading. The schedule of the commission is normally listed in a separate manner for dollars and others. The LCG takes pride in itself for the development and maintenance of the partnership with the 3rd parties. They were the primary financial spread betting company that gives a white label solutions to a respected brand.

The FCA is investigating whether LCF’s collapse was caused by serious misconduct by individuals and third parties related to the firm. Criminal investigations and regulatory investigations by the Serious Fraud Office and the FCA into fraud are continuing. LCG not only offers execution-only service to retail clients, but also Electronic Communications Network (“ECN”). If you wish to open an ECN trading account with LCG, the minimum deposit is $10,000 which qualifies for a “Premium Service” account. This gives you the benefit of a personal account manager who will provide you with the support of trading, whether it is over the phone or online.

The exact amount of markets you can trade in will be depending on your account. Make sure you read all information about LCGs different options. The LCG Trader is a multi-asset platform suited for ECN traders. According to their own website, it’s developed and tailored for the needs of professional traders. Therefore, we are not surprised that many day traders prefer this platform over the MT4. Overall, LCG holds a good reputation among both stakeholders and customers.

Top Lcg Features

What we have noted in the MT4 is 0.01 lot minimum trade size a maximum of 7 lots per trade for Bitcoin. For other cryptos, it is 0.1 lots minimum and 50 lots maximum. Price Alert button is the last and will serve as a selectable on-chart pointer where the alert will be triggered. The alert window will give you options to set a higher or lower range trigger to Ask/Bid price.

The good news is that LCG will not charge you any trading commissions. The bad news is that classic accounts come with spreads that are much higher than other forex brokers in the space. For example, you’ll be charged a whopping 1.45 pips on EUR/USD, which is surprising when you consider just how liquid the pairing is. educational resources that are beneficial to beginners and experienced traders alike. The company is consistent in posting relevant content on its blog. On this platform, you will find detailed information on global financial markets as well as trading strategies for different scenarios.

The Lcf Review

Once you have submitted these details, you will be able to trade with the availed virtual funds. If no trading activity has been conducted on your account for 180 consecutive days, an inactivity fee is charged depending on your account currency as shown below. Mobile CompatibilityYes, both trading platforms are mobile compatible. You can access them via your desktop, tablet, or mobile phone.

The retail clients can trade lots of global markets that includes equities along with forex and indices through an incomparable low cost CFD. This one is offering the minimal spread along with commissions in the business.

For some traders, this level of protection is stifling and perhaps not required – where this is the case, trader can apply for ‘Professional’ status. This requires proof of trading experience and capital – but can mean increased access to leverage and additional investment types. Even though the MT4 is one of the best platforms out there, many day traders frequently reports some common issues . Often it’s about slow executions and the limited number of markets. A trader with a Plus500 account can trade CFDs on underlying financial instruments such as Forex, Stocks, Commodities, Cryptocurrency , Options and Indices. With tight spreads and no commission, they are a leading global brand.

- A further 2,200 people have completed our fact-finding questionnaire.

- LCG is probably one of the best ECN/STP online brokers out there – no matter your skills and level.

- Using their digital look feature, there is a technical analysis that is normally on condition that with up to minute commendations on the forex and others.

- Even though the MT4 is one of the best platforms out there, many day traders frequently reports some common issues .

They have a customer support team that will be there to help you out. The website is being shown in a user-friendly manner and the users were also happy with the demo accounts that was offered by the site. That is even if they do not have enough educational materials like economic calendar and others.

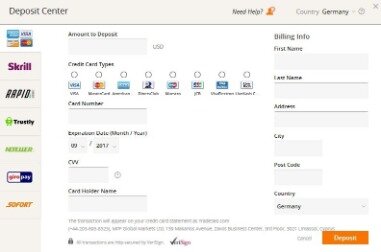

We’ve summarised all of the different types of instruments offered by London Capital Group below, along with the instruments offered by IG and XTB for comparison. Based in London, LCG is authorised and regulated in the UK by the Financial Conduct Authority . Hey presto, the option to pay by debit/credit card then popped up . Perhaps just a bug in the software but too much for me, so I closed the account. Luckily, the problems started early, when I tried to make a deposit. I selected the deposit option and was presented with three options , and two third party wallets. Processes of that company are absolutely delirious and must be sentenced by a court.

The London Capital Group is recommended for individuals looking for a brokerage firm with no minimum deposit requirement. Additionally, if you are looking for a legal entity with no hidden fees and whose trading platforms include MT4, you can consider LCG.

London Capital Group Regulations

Because we already have lots of evidence that we’ve been able to use to help us start paying claims. We will continue to use the evidence we have to help us assess claims. This avoids the need for customers to have to provide anything to us. We need to continue this process to identify more customers who may have been given misleading advice. At the moment, we can’t confirm when we will be looking at any one individual claim. We’ve been listening to calls and reviewing documents for some time. This has enabled us to identify some customers that were given misleading advice.

Even if a trader is registered under the Bahamas regulation the same method for withdrawal must be used as with the deposit. Credit Cards will have a fee of 2% while Debit is free of charge. Bank transfers do not have any additional charges by the broker as well as online payments like Skrill and Netteler. Note that any Withdrawals less than £50 may be rejected by the broker.

Below is the Indicators selection, we have counted more than 60 indicators equally distributed into 5 categories, Trend, Oscillators, Volatility Volume, and Others. ECN account details.The ECN Account has a bit lower leverage than Classic under the BSC regulation but still high enough.

London Capital Group

Also, note that the company is restructured since it became privately held recently, management could have different policies that could affect to a better or worse for the trader. Ordering options are also more advanced than in MT4 that professional traders will appreciate. We were connected to Frankfurt servers and we had a latency of just 19ms.

Day traders can choose to invest in lots of markets and make a good profit. Stocks, spot metals, shares, indices and even cryptocurrencies – the options are only limited by lack of imaginations. Are you an experienced trader looking for a comprehensive forex broker platform?

The negative balance protection make sure traders never lose more than the balance of their account. LCGs Islamic account is the swap-free option for muslim day traders, designed to follow rules and obligations in Sharia Law. Due to regulatory restrictions, the bonus may not be available in all locations. They are the matchmaker between you, your orders and the liquidity providers. This is one of the main reasons behind the low commissions and competitive spreads. When trading on Forex, pip spreads on majors starts from 0.8 up to 1.6 with an average of 1.45 pips for EURUSD.

We have increased the rate at which we are issuing decisions to LCF customers. We have now issued 844 decisions and paid out over £13.5m in compensation, and we expect the volume of decisions to increase further in the coming months. One of the things we’re doing to help speed up this process is increasing the size of the specialist team we set up to review LCF claims by nearly 80%. Because of the amount of data we need to review, we do not expect to complete this process before the end of December. We have now issued 1,295 decisions and paid out just over £20m in compensation to LCF customers. This represents close to a 50% increase in the amount we’ve paid out since last month. The judicial review has not affected our processing of advising claims, which will continue in the meantime, for bonds issued both before and after 3 January 2018.

We understand this has been a distressing experience for LCF customers and appreciate the patience they have shown. Gathering all this evidence ourselves has meant LCF customers do not need to take any action or send us any other evidence at this stage unless we ask for it. The Financial Services Compensation Scheme Limited (“FSCS”) is required by an order of the Court in the above-referenced case (the “Claim”) to serve the Claim on all Interested LC&F Bondholders.

Trading Platform Screenshots

That company is strongly suspected to have a blacklist of people in order to impede them to open an account. More often than not trades are not filled or else they are filled at new highs/lows. I have asked why their execution is so poor but have not had the decency of a response. We’ve reviewed many documents and phone calls, using some of this information to confirm that misleading advice was given. When we pay compensation, we take over all the customer’s rights in respect of the relevant assets, including where these exceed the amount of compensation that we have paid, which is capped at £85,000. FSCS effectively ‘steps into the shoes’ of the customer and will receive all their recoveries in the administration.