Content

Vantage FX is a top Australian Forex and CFDs trading brokerage that provides unparalleled access to the global financial markets to traders around the world. The brokerage is very well-established as they were founded in 2009 and have won multiple awards from numerous publications. Vantage FX is an international trading brokerage but is based out of Australia with their headquarters located at Vantage FX, 29/31 Market St, Sydney NSW 2000, Australia. Since they’re based out of Australia, Vantage FX is licensed and regulated by the Australian Securities and Investment Commission . This is a highly reputable regulatory agency and helps to ensure the broker remains transparent and fair with their trading services. With so many viable online trading brokerages to choose from, it can be difficult knowing which one to choose. Especially when there are so many fraudulent brokers in the financial trading industry.

It separates customer assets from its own, which would then be kept with tier-one banks. ETX Capital doesn’t recognise clients from the United States, Belgium, Canada, Singapore, or any other country where its facilities will violate relevant laws and legislation. Due to regulatory requirements, certain ETX Capital features and products listed in this ETX Capital analysis may not apply to traders from some nations. Highway Media Group would like to remind you that the data contained in this website is not necessarily real-time nor accurate.

Regulation should be an important consideration if trading on the forex market. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. Note however that the spreads/commissions on such micro accounts tend to be quite adverse. Variable spreads change, depending on the traded asset, volatility and available liquidity. The fee structures differ from one forex broker to another, and even from one account type to another. Company Background and History – Knowing the past exploits of your forex broker can give you a better idea of what it is up to now.

Ubanker Review Forex Broker Review (

During day trading this will not involve big trades shown above. I want to bag price movements , so I need to use something that finds these price cycle moves and reversals. For binary forex I use 3 indicators with very precise functions. Combining Fibonacci with precise price channel calculations and information on how others trade, you have a profitable trading strategy for forex.

You pay for them through spreads, commissions and rollover fees. Education – It never hurts to improve your understanding of how the forex markets work and how you can make the most of the opportunities they present. CFDs and FX are complex instruments and come with a high risk of losing money rapidly due to leverage. Pepperstone offers spreads from 0.0 pips on the Razor account and have almost 61+ pairs available to trade.

They only offer a one-step login process, and you will not be able to use facial recognition or fingerprint to log into your trading platform account. MT4 consists of automated monitoring, advanced trading charts, and live technical analysis.

Order execution is extremely important when it comes to choosing a forex broker. If you are looking for this method specifically, you will need to seek out an ECN forex broker. A proper regulatory agency will not think twice about handing out cease and desist orders to dishonest brokers.

Try as many as you need to before making a choice – and remember having multiple accounts is fine . Offshore regulation – such as licensing provided by Vanuatu, Belize and other island nations – is not trust-inspiring. Beyond a nominally available dispute-resolution system, such regulatory coverage offers you no protections. Forex brokers catering for India, Hong Kong, Qatar etc are likely to have regulation in one of the above, rather than every country they support. The most common methods are bank wire, VISA and MasterCard. The majority brokers tend to accept Skrill and Neteller too.

However, not every forex broker is reputable or right for you. A forex broker is a company or firm that provides traders with a forex trading platform that facilitates the buying and selling of foreign currencies. The forex broker acts as an intermediary between the trader and the interbank- a network of banks that trade foreign currencies with each other. Swissquote was started back in 1996 and it is a publicly-traded company in Switzerland.

Trade Forex on 0.0 pip spreads with the world’s leading True ECN forex broker – IC Markets. FXGlobe is a broker licensed and regulated by the CySec. While regulation gives to brokers much needed credibility, it still does not mean every regulated broker is honest. In order to be sure that FXGlobe is not a scam, read our trader reviews and check other popular trading related websites and forums. They are available for Forex trading 24 hours a day, five days a week; the only exception is thatCFDshave certain trading hours that are enlisted on their website. With Globex360, they have the priority to allow traders to make smart and decisive trading plans.

Market Research And Trading Tools

The only thing that traders find discouraging is the long process of withdrawal. As an overall, MetaTrader4 mobile application is suitable for traders who like trading on the go, and at no specific time. The mobile trading platform provides traders with the option of looking through their fee reports, past portfolios, and search functions for trading instruments. As an overall, the MT4 Desktop Terminal is available for traders who prefer a stable environment for trading. There is only one available Globex360 trading platform, which is the MetaTrader4. The MT4 trading platform is available and accessible for all traders, through their desktop terminal and their mobile application. The available trading instruments on the Basic Account are Forex, Commodities, and Indices, with the MT4 trading platform.

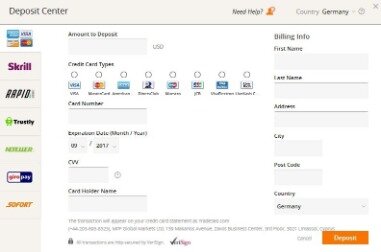

In order to start trading with FXGlobe, you have to deposit at least 250 USD. The MetaTrader4 Desktop Terminal has the option of setting alerts and notifications on your desktop device, which means that you will get an email or notification whenever a price changes. You will also get an alert when your price has reached the target that you wanted.

It will stimulate trading ideas by including a rundown of the coming week, a technological roundup, and an overview of key economic events. Currency trading on margin involves high risk, and is not suitable for all investors. Trading or investing in cryptocurrencies carries with it potential risks. Picking the right broker is no easy task, but it is imperative that you get it right. While we can point you in the correct general direction, only you know your personal needs. Take them into account, together with our recommendations. If it routes the trader’s order through a less-than-optimal path, it has to disclose this fact to the trader.

Coinsquare Cryptocurrency Exchange Review (

Globex360 will also not cover conversion fees, if the trader deposits or withdraws funds that are a different currency than that of the trading account. With Globex360, traders have the option to withdraw and make a deposit through their Client Area by utilizing any of they available funding option that traders prefer. There are three different account types for Globex360, which all have different features for all kinds of traders. Leverage is a form of a loan to the client that enables you to get a much larger exposure to the market you are trading than the amount you deposited to open the trade. Leveraged products, such as forex trading, magnify your potential profit – but also increase your potential loss. With Globex360, there is a possibility for traders to face a negative balance if they use the maximum leverage level that is available.

It might be worth investing more for a platform that suits you better, so stay open minded. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Recent customer care issues have severely damaged the reputation of the brand. Videforex offers leveraged trading on major, minor and exotic currency pairs. 83.57% of retail investor accounts lose money when trading CFDs with this provider.

All in all, it’s hard to see anything wrong with the IronFX broker, but what exactly makes them so great and what kind of trading services do they provide? Find out in our in-depth IronFX Broker Review where we delve deep into all aspects of this lucrative trading brokerage and lay out the results for your viewing. IFC Markets is an internationally recognized online trading brokerage with extensive experience in the global financial markets.

Some may offer the additional layer of protection of 2FA (Two-factor authentication) to ensure only you have access to the account. Forex brokers not affected by ESMA can afford to give you potential extra value through promotions.

- They are very updated with what’s going on in the stock market and they help you with how to navigate tradings.

- However, it can be excruciating if the trend is sharp and continued.

- The MT4 Desktop Terminal is one of the most popular and well-known trading platforms across the world with many user-friendly features.

- With all these comparison factors covered in our reviews, you can now shortlist your top forex brokers, take each for a test drive with a demo account, and select the best one for you.

- Also, with binary trading there is no real secondary market.

The knowledge base is an extensive guide on trading and all of the features that make up a trading decision, and how to trade with international capitals. Many traders use this guide to be able to understand the inner-workings of the trading industry, and everything they need to know about it.

Plus500 Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. However, because the broker is regulated by the CySec, there is a high chance that it is not a scam. With that being said, it still does not mean that FXGlobe is the best option, as there are also hundreds of other regulated brokers with similar or even better trading conditions. Globex360 is not only distinguished in its structure, but in its trading tools that make a difference with traders of all experience. Globex360 provides a wide array of trading instruments such as Forex, Indices, Precious Metals and Energy, and Crypto-currencies. They have very strong commitments to the best quality of software and quality assurance to make sure that traders receive top-notch and transparent experience in trading. Regarding the security of the MT4 mobile application, you will not find the option of a two-step login process.

Choose the “Account history” tab at the bottom and right-click to choose custom dates or save the reports to your computer. CedarFX makes money by charging variable spreads on every transaction made via its trading platform. If CedarFX implements these over time, as is likely with the company being so new, then it will be a good option – especially for environmentally-minded investors. As it stands, the broker offers decent coverage, the MT4 platform, and the ability to pay with Bitcoin.

Many would argue that this strategy will not work in specific market conditions. The point though, is that markets are binary; the price will only go up or down. Any system has the same ultimate goal – to detect the best entries and exit points for any given trade. One thing that is common to both markets is the analysis needed to make a trading decision. Whichever market you are going to trade in you will always be looking at Fundamentals and/or Technical Analysis. For both markets you will need to hone your analysis skills and create a profitable trading plan or strategy. With Binary Options you may not need to be in front of a screen for many hours a day to follow the markets on a constant basis as may be necessary when trading Forex.

We have scanned fees that FXGlobe charges when trading popular currency pairs, here is their breakdown in pips. Globex360 is fully in accordance to the Financial Intelligence and Anti-Money Laundering Act 2002 , the Prevention of Corruption Act and the Prevention of Terrorism Act 2002 . It also keeps client funds stored in segregated accounts, away from corporate funds. It is a good broker, because it is regulated by the Financial Conduct Authority in South Africa .