Content

Liability for direct and indirect consequences of these proposals is therefore excluded. The comparison values are based on data from 15 Forex / CFD brokers. You do not have to comment to rate but feel free to comment if you have an opinion on this broker. Though XTB has an excellent reputation and is praised by many, are they the right trading brokerage for you? Let’s find out in our in-depth XTB Broker Review as we uncover the facts and aspects of this lucrative online trading broker. XTB is a well-established online Forex and CFD trading broker with more than 14 years of experience and an international presence with offices in more than 10 countries around the world.

The provision is based on tight spreads from 0.3 pips on market level operations, and bonuses for active consumers. TradingBeasts helps individual traders learn how to responsibly trade binary options and CFDs. We verify and compare brokerage companies and warn our readers about suspicious projects or scam marketing campaigns. We are also a community of traders that support each other on our daily trading journey. The fees and commissions imposed on traders at XTB are very competitive with the industry standards and are even considered favorable.

Account Types

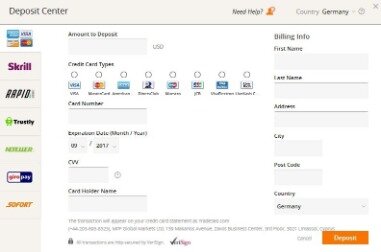

Just remember that you must typically use the same method to withdraw as you did to deposit. Card payments are usually instant, though your first may be slower, and eWallet deposits are also usually instant. XTB deposit methods encompass all the usual methods you would expect. This means wire transfer, credit/debit cards from Visa and MasterCard, and eWallet deposits from Skrill, Neteller, PayU, and more, are accommodated. When you are making an XTB deposit, you can typically do so in EUR.

ECS is not a Financial Services firm and does not operate as a financial services firm. ECS does not gain or lose profits based on your trading results and operates as an educational company. Elite CurrenSea is a trading name operating in the interest of SonderSpot OU, Nenad Kerkez & Chris Svorcik. Remember that software’s past performance does not ensure future results and you may lose some or all of your invested capital. Therefore, do not risk the capital you can not afford to lose.

Xtb Summary: Who Is Xtb Suitable For?

I suspect that the difference may be rooted in the market vs non market maker execution. There are two account types “pro” & “standard” that differ in commissions. Despite sales people trying too hard sometimes, the account should be ready within the same day – without complicated procedures involved.

The risks involved in trading may not be suitable for all investors. ECS doesn’t retain responsibility for any trading losses you might face as a result of using the data hosted on this site. The number of tools, news feed, and built-in recommendations make XTB one of the best brokers in that regard. XTB’s webinars provide an opportunity to learn from experienced traders, as well as interact with the whole class – including the mentors and XTB account managers. A minor red flag on quality of support showed up, when the account manager hasn’t clarified the full cost of keeping a Forex trade overnight . This being said, the quality of customer service may vary depending on each local branch. XTB offers a substantial amount of CFDs, most of the traders will find their favourite instruments around here.

This comes in the form of negative balance protection, meaning you can not lose more than you have deposited in your account, and the holding of your funds in segregated accounts. This means that if XTB did encounter any financial trouble like insolvency, or bankruptcy, your money would not be impacted. With IFSC regulation you may find the broker has higher spreads in some cases but they do offer several account type options with a Standard A, Standard B, and Standard C choice. The minimum deposit here can range from $1 with 2.8 pips starting spreads, to $15,000 and a 0.7 pips spread start. The choice you make really will depend on your individual needs but you can certainly rely on XTB to offer very fast trade execution thanks to its direct market access. Focusing more closely on the minimum deposit, in most countries, there is no XTB minimum deposit. In some places though so as Latin America there are three minimum deposit levels.

These include Canada, and the United States as well as Japan, Brazil, Israel, Iran, Malaysia, and Myanmar. The broker operates as XTB Limited under FCA and CySEC regulations, and as XTB International Limited under IFSC regulation. With the XTB education section, you should find plenty of content to help you out on your learning journey. This includes a very detailed FAQ section that can provide a good level of support for the most common questions and a support team that is available on 10 different phone numbers. You will also be able to trade Bitcoin and many other cryptocurrencies at XTB as CFDs. There are 9 cryptocurrencies available including Bitcoin, Ethereum, Litecoin, Ripple, and others alongside a total offering of 25 crypto assets.

MT4 is available through Windows and Mac with the mobile trading platform being accessible through both Android and iOS with much of the same excellent functionality. Charting tools and indicators are very well provided for at XTB. These are made available through MT4 which is well known for proficiency in this area, and additionally though the xStation trading platform. The minimum trade size you can access with XTB is 1 micro lot. This is equal to 0.01 standard lots or a cash value of $1000 if you are trading without leverage.

You will be asked to choose the trading platform , Account type , Language and currency. XTB offers free educational material to their clients to learn how to trade, on a level which no other broker provides. Established in 2004, XTB is one of the largest stock-exchange listed brokers in the world with a presence in 13 countries, including the UK, Poland, Germany, and France to name a few. XTB gives users free-of-charge access to many tools, such as an individual account manager, stop-limit orders and even online trading training. In order to start trading with XTB, you have to deposit at least 1 USD. Speaking about withdrawals from XTB, they differ in regards to the currency.

Islamic Account: Can I Use It On Xtb?

The minimum spread for the Basic account is 2.0, for the Standard, this amount is 0.35 while for the PRO , it is 0.28. The guaranteed Stop Loss orders are only reserved for the Basic account. The PRO is required to pay commissions on Forex but its maximum order size there is 100 while for the Basic and Standard accounts, this amount is 50. The maximum order size for Indices and Commodities for the Basic and Standard accounts is 15 while for the PRO , that size is 100. There is always a relationship between high returns and high risks. Any type of market or trading speculation that could generate unusually high returns is also exposed to high risk. Trading foreign exchange and futures or CFDs on margin is associated with an enormous risk of loss and therefore not suitable for every investor!

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 65-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money. fxexplained.co.uk is an affiliated partner with various forex brokers and may be compensated for referred forex traders.

Opening any account type with XTB, it is fairly easy and direct, since it is all completely digital. Traders will need to fill out the necessary forms and they can submit all the required documents in a span of 30 minutes. The XTB brand was one of the very first companies that introduced Forex Trading in Poland, and it is now considered to be the fourth biggest stock exchange firm in the country. Email support can be a little slow at times, however, phone support can be rated as excellent. Important and frequently asked information can be accessed easily on the website.

Xtb Vs Other Brokers

Pro account holders would have to pay both commissions and spreads, whereas the standard traders are limited to just spreads. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. XTB is the UK subsidiary of Polish broker X-Trade Brokers, founded in 2002 in Warsaw. The broker supports credit card- as well as electronic wallet deposits.

If this is the case, the broker will charge a monthly fee of $10 until you log back in to your account again. They also reserve the right to close your account if you do not have a sufficient balance to cover the fees. There is a $1 minimum deposit in place for the Standard C account with spreads starting from 2.8 pips.

- XTB was bestowed with the ‘Best Trading Platform 2016’ award for xStation.

- They also provide a very competitive environment in terms of bothe fees and spreads that appeals to scalpers.

- Now what we need is a superb customer centre and XTB is proud to have one which tackles every issue that may arise with the highest levels of professionalism, focus, and attentiveness.

- Brokers are compared according to various criteria such as minimum deposit amounts, fees and commissions.

- Both of these can form the foundation of your forex trading career and are very important aspects to consider when making your broker choice.

The tradable instrument section is amazing and Demo accounts are available. Both platforms support real money- as well as Demo accounts.

The xStation 5 platform was voted 2016’s “Best Trading Platform” by the Online Personal Wealth Awards and offers reliable and instant execution without re-quotes. It offers free audio commentary on the markets – a paid service with other brokers – as well as an advanced trading calculator that instantly determines every aspect of your trades. Trading CFDs, FX, and cryptocurrencies involves a high degree of risk. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. Cryptocurrencies can widely fluctuate in prices and are not appropriate for all investors.

XTB is a CFDs broker, every asset listed on the platform is offered in CFDs. Here is a selection of all the markets you can choose from with XTB. As a forex trader with XTB you will no doubt be interested to know all about the trading experience at the broker and the various features that they cater for. Here is a detailed look at what you can expect from the trading experience at XTB. This inactivity fee only applies to live trading accounts, and not to XTB demo accounts. This XTB inactivity fee will only be charged if you are inactive for 1 year.

Which forex brokers are market makers?

Market Making BrokersBrokerDetailFXTMMin. Deposit: US$200 Max. Leverage: 1:30 1:200 Trading Platforms: MT4, MT5, FTXM Trader Regulation: CySEC,FCA, FSCA1 FXTM ReviewGO MarketsMin. Deposit: 200 US$ Max. Leverage: 1:500 Trading Platforms: MT4, MT5, WebTrader Regulation: ASIC, CySEC2 GO Markets Review8 more rows

Today, XTB Online Trading has offices in 13 countries, including the UK, and boasts more than 140,000 clients worldwide. It’s commission structure, research tools, well-executed web/mobile platforms & low deposit/withdrawal fees puts it the basket of the best European brokers. XTB xStation is the broker’s own proprietary trading platform. It is an award-winning platform which is extremely accessible through both a webtrader and mobile version. The trading platform is compatible with both Windows and Mac while the mobile platform runs through Android and iOS without issue. The overnight fee is that which you must pay if you hold a position past the close of market.

But XTB once again comes through for forex traders by also offering MetaTrader 4. This trading software is much more difficult to use than what eToro offers, but it is also more customizable than eToro’s platform. XTB Online Trading is a highly reputable broker with more oversight than many other online brokers in the UK. The broker is regulated by several different financial authorities, including the UK’s own Financial Conduct Authority and the Cypress Securities and Exchange Commission. All UK clients trading with XTB have negative balance protection, meaning that you cannot lose more money than you have in your account when trading with leverage. The broker charges a flat commission of 0.08% for every stock and ETF trade, regardless of what type of account you have.

They have various high-quality videos to pick from, but also some great trading platform videos in particular. These will help you to get used to the trading platform, and also to help you get to grips with the wider industry. If you find the terminology of trading a bit complex and are still getting used to it, then you can get a lot of help thanks to the educational tools on offer here.

XTB also offers the added layer of protection to prevent risk warning, where each client has up to fifty thousand Euros, in the off-chance of insolvency. The custom platform offers the most features in an intuitive manner while MT4 is also available for traders who prefer the more standard platform. While its overall costs are lower than its competitors, its offerings are slightly limited. For fast and easy signup and free transaction, XTB is a contender platform for new users. Regular functions like entering a trade, creating a watchlist & tracking it, as well as modifying the charts is easy as the platform is fairly responsive.