Content

ATFX UK provides a list of default leverages for clients that can be found in its Trading FAQ section. The platform provides a range of order types with pending order options, including Sell Stop, Sell Limit, Buy Stop, and Buy Limit, which are connected to company instructions residing within the server. ATFX UK operates a “no dealing desk” policy, reducing broker intervention and improving the transparency of trading conditions and the trading environment.

The ATFX website offers a browser-based live chat feature, which is arguably the most effective way of getting assistance. ATFX shines in this category, with extensive research and analysis from in-house analysts that serves to demystify the trading process. The educational resources are broader in nature but equally useful, with segmentation between beginner, intermediate, and advanced topics.

The firm is also regulated in North America and the Middle East. Due to this global approach, the firm is popular in regions such as Malaysia, the Philippines and Thailand, where traders often look for both local, and European regulation. Throughout the webinars, there a real-time insight provided to traders to boost their training.

We strongly advise you to only deal with financial firms that are authorised by us, andcheck the Financial Services Registerto ensure they are. It has information on firms and individuals that are, or have been, regulated by us. In order to start trading with ATFX, you have to deposit at least 500 USD .

- The combination of downloadable platforms for both Mac and Windows allows traders to trade with their device of choice.

- 74.07% of retail investor accounts lose money when trading CFDs with this provider.

- The second quarter offered some advantageous trading opportunities across all asset classes, and ATFX’s analysts predict that the next quarter could be just as fruitful .

- In this review, we will be critiquing the services provided by ATFX.

- Users can set their preferred display methods and parameters for every type of chart and indicator.

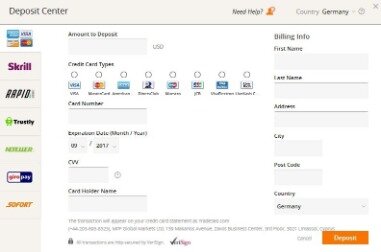

One of the ways that it does so is by availing a range of educational resources that are helpful in improving one’s knowledge and skills on trading. ATFX UK has four different types of accounts, all with different minimum deposit requirements. For instance, the minimum deposit required for the professional account and edge account is $€£ 5,000. For the premium account, you will need a minimum deposit of $€€ 10,000 while that of the standard account is $€£ 500. If you are ready to trade with real funds, then you can create a live account by going to the website’s homepage and clicking on ‘open live account’. After selecting your preferred language, you will be requested to fill in your personal details. You will then be required to fill in your financial details, experience, knowledge on finance, and acknowledgements as shown below.

This area of the ADVFN.com site is for independent financial commentary. These blogs are provided by independent authors via a common carrier platform and do not represent the opinions of ADVFN Plc. The information available at ADVFN.com is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by ADVFN.COM and is not intended to be relied upon by users in making any investment decisions.

Trading

ATFX Team-Up – The firm recently launched a social-trading platform called ATFX Team-Up. Clients will be able to follow and mirror other traders in the community, as well as interact over the web by sharing ideas and opinions. One-to-one coaching from ATFX account managers is available upon request, this depends on the account type you have. If you have an Edge account, you’ll benefit from one-to-one coaching with Alejandro Zambrano. He will assist in creating a personalised trading plan tailored to your specific needs and goals.

They may have to deposit at least USD/EUR/GBP 10,000, but for that money, they will trade almost spread-free. Additionally, it offers a wide range of trading instruments; some of which are not offered by other brokers. ATFX UK customers can trade in shares, CFDs, FX, Precious metals, currencies, cryptocurrencies, indices, and commodities. However, adding bonds and ETFs can further increase the value of the ecosystem. For beginners and experienced traders alike, ATFX UK is one of the reliable brokers in the market. In addition to being a licensed FX and CFD broker that is regulated by FCA, it complies with MiFID and FOS. From this perspective, clients can confidently trade with the broker without fearing the loss of their funds or unauthorized use of their personal details.

Individuals trading with ATFX UK can either use the desktop, web-trader, iPhone, or Android version of the MT4 trading platform. For the professional and edge accounts, the spreads start from 0.6 pip.

Customer Service

The trading platform provides its clients with the ability to trade a range of assets via the company’s user-friendly platform that supports MetaTrader 4 software. ATFX offers competitive pricing to its clients and provides a state-of-the-art client portal that is protected by leading encryption security systems. ATFX are an award winning online broker offering Forex trading, CFDs and spread betting. This review covers everything from the Metatrader 4 trading platform, to account safety and security.

The EEA includes Liechtenstein, Norway, Iceland, and all 27 EU member states. Alejandro Zambrano, the site’s Global Chief Market Strategist, presents a webinar each day that addresses the current trends and states of particular financial markets. The user’s bank account must be fully verified before a withdrawal can be made. All funds are returned to the original payment source that was used to make the deposit. No fees are charged for withdrawals, and monies can be paid into debit or credit cards, E-wallets, or directly to a user’s bank account. Withdrawal requests received on a business day before 2pm are processed that day.

What Youll Need To Open An Account With Atfx Global Markets

TradingBeasts helps individual traders learn how to responsibly trade binary options and CFDs. We actively trade, publish educational articles and news. We verify and compare brokerage companies and warn our readers about suspicious projects or scam marketing campaigns.

Premium Education – Opening a premium account with ATFX means unlocking a number of exclusive benefits including, premium tutorials and videos, as well as full access to Trading Central. The premium education feature compliments the free VPS and raw spreads that this account type offers. In September 2019 the firm launched its ATFX Connect brand, to cater to high-end professionals, corporates, and institutional level clients. This development indicates ATFX’s full-spectrum knowledge of its industry in all its iterations. The minimum deposit for this account type is USD/EUR/GBP 5,000 too.

The operator of this website does not verify this information and is not responsible for its accuracy, completeness, timeliness, truthfulness or the compliance of a broker with legal regulations. Please verify whether the broker is authorized to provide its services in your country of residence in accordance with the legal regulations that apply to its business. On 19 December 2012, the Financial Services Act 2012 received royal assent, and it came into force on 1 April 2013. The Act created a new regulatory framework for financial services and abolished the Financial Services Authority. The FCA regulates financial firms providing services to consumers and maintains the integrity of the financial markets in the United Kingdom. It focuses on the regulation of conduct by both retail and wholesale financial services firms.

All inquiries will be directed to the same email address, while phone calls will need to be made to the office corresponding with one’s location. Response time is typically one day through email or social media. As usual, we did attempt to try out the LiveChat feature; however, we were greeted with a message stating that agents were not available at the time. Considering that this was within business hours, we were disappointed with the service and it made the instant contact option seem less convenient.

Whatever you need in regards to FX trading, you will probably find here. Be aware that you will trade currency pairs via CFDs, like the other assets offered by the broker. Edge Account – The Edge account requires a minimum deposit of £$€ 5000 offering a minimum spread on the benchmark EUR/USD currency pair of 0.6 pips. Standard Account – A Standard account requires a minimum of £$€500 and offers a minimum spread on the benchmark EUR/USD currency pair of 1.0pips. Financial market trading carries a high degree of risk, and losses can exceed deposits.

To understand recent developments within the Forex industry, it’s necessary to review how they emerged and what the driving forces are behind important trends. ATFX’s highly-regarded and compelling Q3 Market Outlook Report is the must-have guide for any new or experienced trader. If you do not have the extra capital that you can afford to lose, you should not trade in the foreign exchange market. No “safe” trading system has ever been devised, and no one can guarantee profits or freedom from loss. If you use an authorised firm, access to the Financial Ombudsman Service and FSCS protection will depend on the investment you are making and the service the firm is providing.

Crispus graduated with a Bachelor’s of Science in 2013, an MBA in 2017, and is currently working on an MSc in Financial Engineering from WorldQuant University. When he is not trading and writing, you can find him relaxing with his son. As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website. The Premium account must have a balance of at least £$€10,000 with a benchmark spread currency pair of 0.0 pips.

All the company’s terms and conditions relating to their specific products and services can be found here. Users who open a Premium account receive a number of exclusive benefits, including premium videos and tutorials, as well as having full access to Trading Central. The idea of the Premium education feature is to complement the free raw spreads and VPS that are offered by this type of account. Recently ATFX UK opened a Forex education center that can be accessed by clients on the company’s website.

The WebTrader also covers some 13 indices, representing all the important nooks and crannies of the world economy. The platform has the capability to be used as a web-based platform through a web-based browser, and as an application on smartphones and tablets. You can easily change the size and the position of the tabs. A demo account is available and ATFX clients can download several versions of MT4 for free; MT4 Desktop, MT4 WebTrader and MT4 mobile, with apps for Android and iOS. In addition to the usual selection of currency pairs and various derivatives, ATFX also features UK-specific financial spread betting. Learn two complete trading strategies to optimize your trading for fast-moving markets. ATFX UK is keen on catering to the needs of professional traders and beginners alike.